By Doug Kronk

•

December 8, 2023

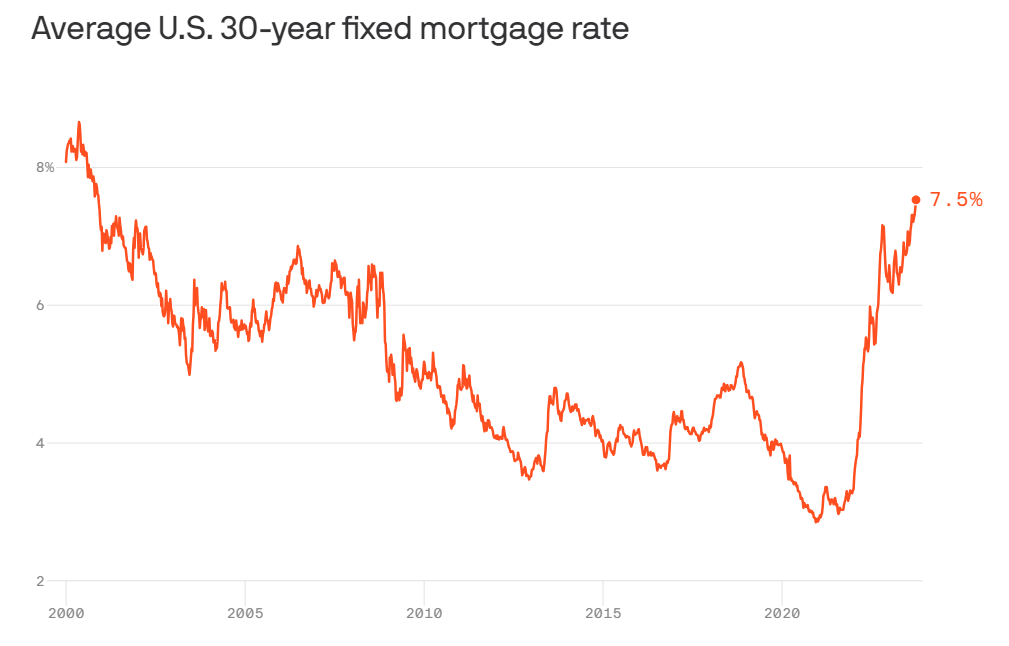

While national focus has been on uncertainty around new tax laws, there are many individual tax-planning opportunities you should consider before year-end to ensure you are getting the best deal while staying compliant. Although the Tax Cuts and Jobs Act of 2017 and SECURE Act of 2019 captured national attention, there are still plenty of tax-planning opportunities you need to pay attention to, particularly if there has been a change in your financial situation during the year. Good tax planning enables you to stay compliant while positioning yourself to pay as little in taxes as possible. Reaching out to your CPA regarding specific tax planning ideas at the end of the year is always smart. Here are some common areas to consider regarding your tax situation as the year is wrapping up. 1. Compare income year over year And don’t forget about making quarterly estimated tax payments when newly retired. Is this year shaping up to be better, worse, or similar to last year? Depending on the answer, you may need to adjust your withholdings and estimated tax payments, particularly if you are newly retired. As a result of the new tax law, there are revised withholding tables in 2018 that could decrease the amount you are required to withhold. On the other hand, you may need to make additional quarterly tax payments if you owe more in taxes than the previous year or risk a penalty for not paying enough taxes unless you are otherwise in the “safe harbor.” Additionally, you should pay state property taxes before year-end to get a federal tax deduction (limited, of course, by the $10,000 SALT deduction that started in 2018). 2. Any big sales this year from stock accounts? Or has there been a rebalancing in taxable accounts? If so, keep an eye on the tax bill. This includes inherited investment accounts; you receive tax-free, but any subsequent sales are taxed. Don’t wait until the end of the year to calculate the taxable gains, and remember to consider harvesting losses to offset those gains. 3. Have you received an inheritance? Although the initial bequest is typically tax-free to the heir, any subsequent sales are taxed on your tax return. And, beware if you are named the beneficiary of an IRA, annuity, or company retirement plan, where the rules vary dramatically. You could be forced to take withdrawals as the original owner was and taxed at his or her highest tax bracket. However, if you inherit a Roth IRA, payouts are tax-free over your life expectancy. 4. Have you bought, sold, or refinanced a house? The profits from the sale of a principal residence are typically tax-free (up to $500,000 for a married couple), but there are some wrinkles, so make sure you qualify. In addition, if you paid off a mortgage on which you were deducting points year by year, you can deduct the remaining balance this year. And if you refinanced your mortgage, it may be possible to generate amortization of points. 5. Visit your CPA before making any charitable donations To confirm that you are taking advantage of all tax breaks available while simultaneously not incurring any penalties, make sure you see your CPA when considering charitable donations. For example, consider donating appreciated securities instead of writing out a check. You can also save money by transferring a required minimum distribution (RMD) directly to a qualified charity, thus avoiding paying taxes on the withdrawal. (Note: You can make these direct transfers after age 70 1/2, but RMDs start at 72.) The result would be a reduction in your taxable income. (But also be aware that the donation maximum is $100,000 and you will not qualify for a charitable deduction when filing federal income taxes). All things considered, it is generally beneficial to make the contribution directly to the charity, rather than take the deduction. 6. Calling all newlyweds! And those who are recently widowed or divorced. Has there been a marriage, death, or divorce? If you got married this year, you should consider how tax rates can increase for a two-earner couple or decrease for a single-earner couple. In addition, if one spouse of a newly married couple is jobless, the unemployed spouse may be able to fund an IRA (despite his unemployed status) if the other spouse is working. Beginning in 2019, alimony is no longer deductible for the payor nor treated as income for the recipient. Divorce settlements need to reflect this. Also, make sure you review who is able to deduct the dependents. If you have been widowed this year, you can still file jointly for this year (next year, you are required to file “single”), but you need to consider possible decreases in income and potential decreases in estimated tax payments. While filing jointly can increase the deductions you are entitled to, make sure to watch out for any possible negative repercussions. You should also review all sources of income with your financial professional to ensure that you get what you are entitled to from the estate and that you understand the distribution rules. 7. Special tips for parents of college students and recent grads The American Opportunity Tax Credit gives parents of college students a tax break worth up to $2,500 of tuition per eligible student for the first four years of college. And recent mid-year grads (or anyone who will not work more than 245 days this year) can request their employer use a part-year method to pay them, which will result in employers withholding less money, leaving more for you. 8. Newly retired? Take control of your tax bracket Discuss tax bracket management with your CPA, so that you are remaining within (and using up as much of) your current tax bracket as possible, whether that is the 10% tax bracket or a higher tax bracket. These strategies could include maxing out on pretax retirement accounts and also taking withdrawals from qualified accounts so that you are converting pretax dollars to after-tax dollars, potentially at a lower rate. However, if you need more income, you should consider doing one or more of the following: withdrawing cash (tax-free) through loans on a universal life insurance policy (although this will deplete the policy’s value), taking out a home equity line of credit (although interest is no longer deductible), or deferring Social Security benefits to reduce long-term tax costs. 9. Consider how recent tax laws affect your situation The tax bill signed into law at the end of 2017 brought some of the most sweeping changes seen in the past 30 years. Perhaps most notably, the standard deduction was doubled, meaning you will need to carefully consider how to maximize your deductions. A host of other changes involve state and local taxes, medical expenses, alimony payments, and more. Then, two years later, the SECURE Act brought a host of changes to retirement plans, reflecting the reality that Americans are living longer and that many haven’t saved enough money. In short, new tax laws haven’t really simplified anything, but there are still plenty of opportunities for tax planning and savings, so continued vigilance is in order. Advisory Services and Insurance Products are offered through Vector Financial Services, LLC (Vector), an Indiana Registered Investment Advisor and Insurance Agency. Investments may lose value and are not FDIC-insured. Vector may only conduct business in states where the individual and firm are licensed or are exempt. Nothing contained herein should be considered investment advice; a financial professional should always be consulted. All content is provided as a courtesy for informational/educational purposes and on an “as is” basis by an unaffiliated third-party provider who is wholly responsible for the content. Custody and brokerage services are accessed via Intelliflo, with individual accounts held at separate custodial firms, all of whom are members of FINRA/SIPC and are unaffiliated third parties to Vector and/or Intelliflo.